Know Your Deductions! Maximise Your Rental Return

Investment property deductions! Maximise your rental return…

For property investors, it’s important to treat your investments as a business, and claim all deductions against your rental income or capital gains if the property is sold.

“If you rent out your property or it is genuinely available for rent, you can claim deductions for most of the expenses you incur in these periods.”

– Australian Taxation Office (ATO) Website

But while ‘claim all legitimate tax deductions’ may sound straightforward, tax law can be complicated… and often investors will end up ‘under claiming’ or claiming for ineligible expenses relating to their investment properties (and get taxed on them anyway).

To help you maximise your allowable deductions, read on to learn what types of deductions you can and can’t claim for, when you can claim them (immediately, yearly etc), what ‘apportioning your expenses’ means, and knowing when the Capital Gains Tax applies…

You can find out what you are entitled to – and then make sure you claim it!

So, what types of deductions are there?

Generally speaking, you can class investment property deductions into three categories, which will help you identify what items you can claim, and when you can claim them…

- Immediate (in the financial year that you incurred the cost)

- Ongoing (over a number of financial years)

- Capital Gains Tax (only applies when you sell or dispose of your property)

What types of expenses are immediately deductible?

These are costs that you can claim the full amount for, immediately (in the financial year that you incurred the cost).

For a cost to be eligible for an immediate deduction it must be incurred and paid by the owner, not the tenant.

Some examples of eligible immediate deductions include (but are not limited to):

- Depreciating assets that are less than $300 and are not part of a “set” (e.g. x1 dining chair for $70, when it is part of a “set” of x6 that together cost $420)

- Marketing costs to find a tenant for your rental

- Cleaning costs to make the rental property habitable for tenants

- Electricity and gas costs

- Council rates

- Gardening and lawn mowing

- Pest control

- Insurance (building, contents and public liability)

Always make sure you read the conditions for each deduction, as it may be the difference between an ‘immediate’ deduction, and an ‘ongoing’ deduction. For instance, depreciating assets must be brand new (can’t be second hand), and if they are part of a “set” that exceeds $300, they move from an ‘immediate expense’ to an ‘ongoing expense’. Always refer to the ATO website for more information, if you’re unsure.

What types of expenses are ongoing?

These are costs that need to be claimed over multiple financial years.

Some examples of eligible ongoing deductions include (but are not limited to):

- Depreciating assets that exceed $100 and are part of a set (e.g. x6 dining chairs)

- Loan establishment fees

- Interest expenses

- Stamp duty charged on the mortgage

- Lender’s mortgage insurance (LMI) billed to the borrower

- Negative gearing – if your rental expenses exceed your rent profits, you can deduct the net “loss” against your income for the financial year

- Capital works

When does the Capital Gains Tax (CGT) apply?

The Capital Gains Tax only applies in the year that you sell or dispose of your investment property. There are some costs that will not be deductible until you dispose of your property (e.g. acquisition and disposal costs, such as conveyancing, stamp duty etc), that will get included in the property’s cost base, and then be subtracted from your capital gains.

What is ‘apportioning’ and how do I ‘apportion’ my expenses?

‘Apportioning’ is a calculation that helps you figure out your depreciation expenses when your property is only available for part of the year, or you only rent out a portion of the property. Read on to find out when it applies to your investment property…

- If you only rent out your investment property for a portion of the year (e.g. six months), you can only claim deductions for the period of the year that your property was actually available for rent. So, say you have an investment property in Fremantle that you rent out for 9 months of the year (March – November). But, you use it as a holiday home over the 3 month summer period (December – February). This means you can only claim deductions for 9 months of the year. This is because the 3 month summer period counts as private use of your investment property, as opposed to business use (intending to produce a rental income). Private use can also apply if you let your kids to live in your investment property rent free, or at a reduced rate, for a portion of the year.

- If you only rent out a portion of your investment property, e.g. a granny flat, or bedroom, you are only entitled to claim deductions for the floor space of the area that is available for rent, for the period of the year that it is rented. You can also factor in a reasonable percentage of the communal spaces if this is included in the rental agreement.

Apportioning expenses calculation example…

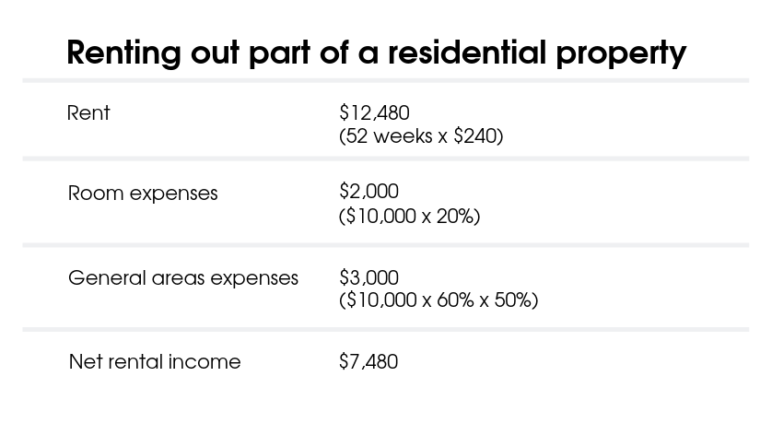

So, if you rented one of your bedrooms (plus access to the kitchen, bathroom and laundry) to a student for 12 months of the year at $240 per week, you would first need to calculate the floor area of these spaces, as a percentage (%). E.g. Say the floor area of the bedroom for rent makes up 20% of the area of your investment property, and the floor area of the kitchen, bathroom and laundry make up 60% of the area of your investment property.

You also need to calculate the ‘share of access’ to the communal areas between the number of occupants in your investment property, as a percentage. So in the example above, there is one paid tenant, plus the home owner, and each has equal access to the communal areas. Therefore, the percentage share is 50%. If there were two paid tenants occupying one room, plus the home owner, and each person has equal access to the communal areas, the percentage share would become 66.6%. And so on.

Then, say your annual mortgage interest, building insurance, rates and taxes for your investment property was $10,000. Using the percentages above, you can calculate that 20% of these expenses (that is, $2,000) applies to the bedroom.

See the table below for the full breakdown of apportioned expenses…

Keep all records of payment expenses for FIVE years…

You must always keep proof that the expenses that you are claiming relate to legitimate business expenses for your investment property.

You must keep all records of payments whenever you incur an expense for your property, for an average of FIVE years from the time of lodgement. Records should always be in English, and include:

- the name of the supplier

- the amount of the expense

- the nature of the goods or service

- the date the expense was incurred

- the date of the document

These expenses should not be guessed or inappropriately apportioned.

This will save you a great deal of time and money when you submit your tax return and any subsequent ATO review or audit as they can legally refuse unsubstantiated claims.

For more detailed information on what you can and can’t claim, head to the ATO website. They’ve got a great guidebook that lists the purchase life of assets and an example list of what you can and can’t claim as depreciating assets.